Private Placements of Corporate Bonds in Vietnam: Are the Proposed New Regulations Designed to Promote or Curb Further Market Development?

Highlights

- The Draft Regulation introduces the following notable changes to existing regulations on corporate bonds:

– Limiting circumstances where a company may issue bonds– International vs. domestic bonds– Credit rating requirement– PSI qualification– Takeaways

When local media reported that a local hair salon owner with equity capital of VND20 billion (less than USD1million) was able to raise VND738 billion (USD32.4million) through corporate bonds, this prompted Vietnamese regulators to look into curbing the exuberance of the market in order to prevent potential excesses and abuses. It remains to be seen whether these new measures will achieve their policy goals.

The private placement of corporate bonds has lately been dominant in comparison with other forms of capital raising by corporates. According to the Vietnam Bond Market Association, the first 9 months of 2021saw 596 domestic corporate bond issues with an aggregate value of VND362 trillion (USD15.9 billion) coming to market. Of these, a full 582 issues took the form of unregistered private placement. Of the 173 issues in Q4/2021, only 5 are registered public offerings.

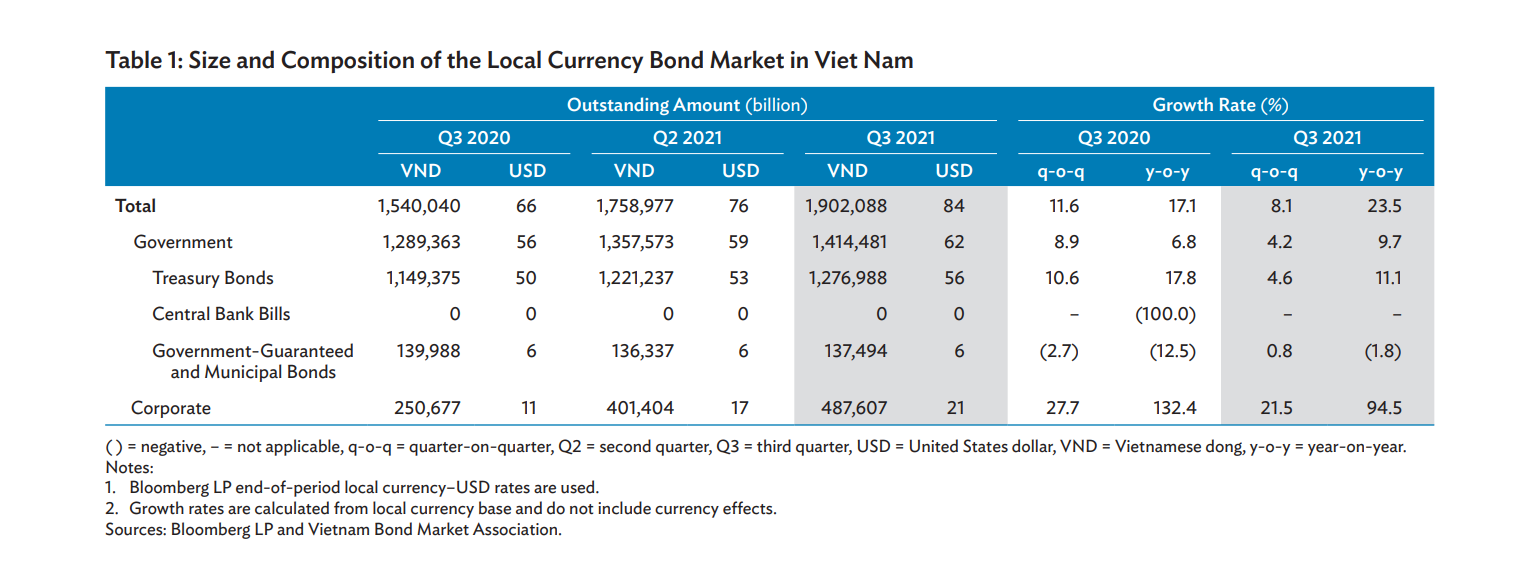

This trend was also highlighted by the Q3/2021 Asian Development Bank (ADB)’s Asia Bond Monitor. The corporate bond market maintained its strong expansion at 21.5% quarter-on-quarter in this period.

(source: ADB report)

Concerned about the potential negative impact of a too fast-growing corporate bond market, Vietnamese regulators have been taking steps to tighten regulations governing the issuance of corporate bonds. In late 2021, the State Bank of Vietnam issued its Circular 16/2021/TT-NHNN which took effect on 15 January 2022 (“Circular 16”). Circular 16 essentially restricts banks from pouring money into corporate bonds since banks have been a leading source of funds for the local corporate bonds. Under Circular 16, a bank is only allowed to buy corporate bonds when its NPL ratio is below 3%. In addition, banks are not allowed to acquire corporate bonds if the bonds are being issued to (i) restructure the debts of the issuer, (ii) contribute capital or purchase shares of other companies, or (iii) increase the issuer’s working capital.

Limiting circumstances where a company may issue bonds

Currently, a company may issue bonds for any of the following purposes: (i) to implement its investment projects or programs; (ii) to increase its working capital, (iii) to restructure its capital structure, or (iv) other purposes as may be provided in laws regulating specific industries or sectors.

The Draft Regulation expressly prohibits using bond proceeds towards equity injection, providing loans or purchasing bonds. The proposed change has expectedly prompted concerns among businesses since using bond proceeds for equity injection as a form of investment is a common practice. Such a practice is particularly important for conglomerates that deploy investment through special purpose vehicles (SPVs). That is because it would be difficult for a newly established SPV without substance to raise funds and in that circumstance, a parent company with substance could raise funds and channel such funds into its SPVs to implement the conglomerate’s investment projects. Using bond proceeds to inject equity into a subsidiary is just an intermediate step in the implementation of the issuer’s investment project; in other words, they should not be regarded as financial investment.

International vs. domestic bonds

Another important distinction that should be built into the regulations would be the distinction between international and domestic bonds. In 2021, there were 3 issues of USD bonds with an aggregate value of USD1billion. The global capital markets already have a well-defined regulatory framework protecting the sophisticated international investors who are the regular participants in these markets. It is unlike therefore that they would need the additional protection contemplated under the Draft Regulation. Hence, the new restrictions should focus on enhancing investor protection in the context of local corporate bond offerings in the still developing domestic corporate bond market. There is no benefit in treating an international offering and a local private placement in the same fashion as this would not advance the policy goals curbing the growth of the domestic private placement corporate bond market and preventing potential excesses.

Credit rating requirement

According to the Draft Regulation, a credit rating is also required if bonds are (i) issued to individual investors; (ii) unsecured or not guaranteed; or (iii) issued by an issuer who incurred a loss in the year preceding the issuance or cumulative losses in the year of issuance. Since there are only two credit rating companies currently in business, and they have limited experience given that the bond markets are still in development stage, there is a strong possibility that they may turn into bottlenecks. It is worth noting that a similar credit rating requirement in the context of a registered public offering will not be applicable until 2023.

PSI qualification

VND bonds issued through a private placement may be traded among professional securities investors (“PSI”) only. PSIs are deemed financially sophisticated and need less protection than most public investors. For the time being, PSIs mainly include institutional investors with substance such as banks, insurance companies or companies with paid up equity of at least VND100 billion but they also include individuals holding a securities portfolio of at least VND2 billion or an annual taxable income of at least VND1 billion. The minimum qualifications for becoming an individual PSI are relatively easy to satisfy and probably need to be revisited as the market matures.

PSI qualifications are verified by the issuer or by the securities firm advising the placement if authorized by the issuer. Currently, PSI verification is not required (i) within one year of the last verification and (ii) for an investor who sells bonds. Under the Draft Regulation, however, PSI qualifications must be verified each time an investor effects a sale or purchase. Obviously, a bondholder who wishes to sell his bonds should not be subject to any PSI test.

Takeaways

The Draft Regulation is another regulatory step, following in the footsteps of Circular 16, aimed at restraining private placements of corporate bonds in a market that may be too fast-growing. The policy objective makes eminent sense given the current Evergrande crisis. However, Vietnamese regulators need to carefully calibrate the policy measures they adopt to tighten regulations governing corporate bonds. Over-regulation could unnecessarily limit funding options of corporates or make it difficult for them to raise funds through private placements of bonds. In addition, PSI qualification should also be revisited to enhance investor protection.

Contributors

Truong Nhat Quang, Managing Partner

Nguyen Van Hai, Partner